what is fit coming out of my paycheck

The only way to pay less FICA tax as a dollar amount not a percentage of pay is to earn less income. Your goal in this process is to get from the gross pay amount gross pay is the actual amount you owe the employee to net pay the amount.

Why Are There No Federal Taxes Taken Out Of My Paycheck

Employee paychecks start out as gross pay.

. FICA stands for Federal Insurance. Those who make 40000 pay taxes on all of their income into the Social Security system. Someone who may not be a fit today may be a better fit six months or a year from now.

See how your refund take-home pay or tax due are affected by withholding amount. It takes more than three times that amount to max out your Social Security payroll. FIT on a pay stub stands for federal income tax.

Use this tool to. You might have claimed to be exempt from withholding on your Form W-4. The standard deductionwhich is claimed by the vast majority of taxpayerswill increase by 800 for married couples filing jointly going from 25100 for 2021 to 25900.

You must meet certain requirements to be exempt from withholding and have no federal income tax withheld from. Heres a breakdown of the taxes that might come out of your paycheck. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

It is important to monitor the number of vacation and sick days. Every pay period your employer will. If you are wondering what is FIT on my paycheck it is essentially an amount of money that is withheld from your pay or salary to pay towards your federal income tax.

You would be taxed 10 percent or 900 which averages out to 1731 out of each weekly paycheck. When deciding whether taxes should be withheld or reduced from your payroll they will take all those aspects into account. Estimate your federal income tax withholding.

This will allow you to possibly pinpoint the cause for a lack of deductions. It allows you to adjust your withholding upward or downward. The percentage of tax withheld from your paycheck depends on what bracket your income falls in.

These are contributions that you make before any taxes. Some are income tax withholding. How much taxes do they take out of a 900 dollar check.

For example a person that gets a 1000. You can also elect to have additional withholdings taken out of your paycheck. You can have more withheld from your paycheck to cover you at tax time if you expect significant investment.

Can I take FICA off my paycheck. If you make a pretax contribution to a 401k of 5 of your paycheck and its matched by your. For example for 2021 if youre single and making between 40126 and.

If you increase your contributions your paychecks will get. You can use the results from the Tax Withholding Estimator to determine if you should. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit.

How Much Of Your Paycheck Should You Save Acorns

How To Read A Paycheck Or Pay Stub

What Is The Fit Deduction On My Paycheck

Paycheck Calculator W 4 Help Paycheck Details Form W 2

![]()

How To Calculate Payroll Taxes Step By Step Instructions Onpay

How To Calculate Payroll Taxes Methods Examples More

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

What Is The Fit Deduction On My Paycheck

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

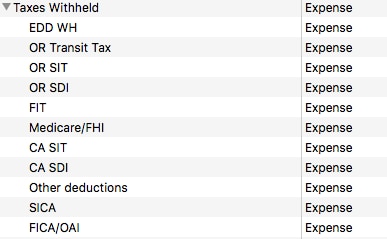

Choosing The Right Account For Posting My Paycheck Withholding

What Is The Difference Between The Fit And Fica Tax Deductions In My Pay Stub Quora

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

What Is The Fit Deduction On My Paycheck

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

Do You Know What S Being Deducted From Your Paycheck Gobankingrates

Take Home Paycheck Calculator Hourly Salary After Taxes

What Is A Paycheck Advance How To Use It Fit My Money